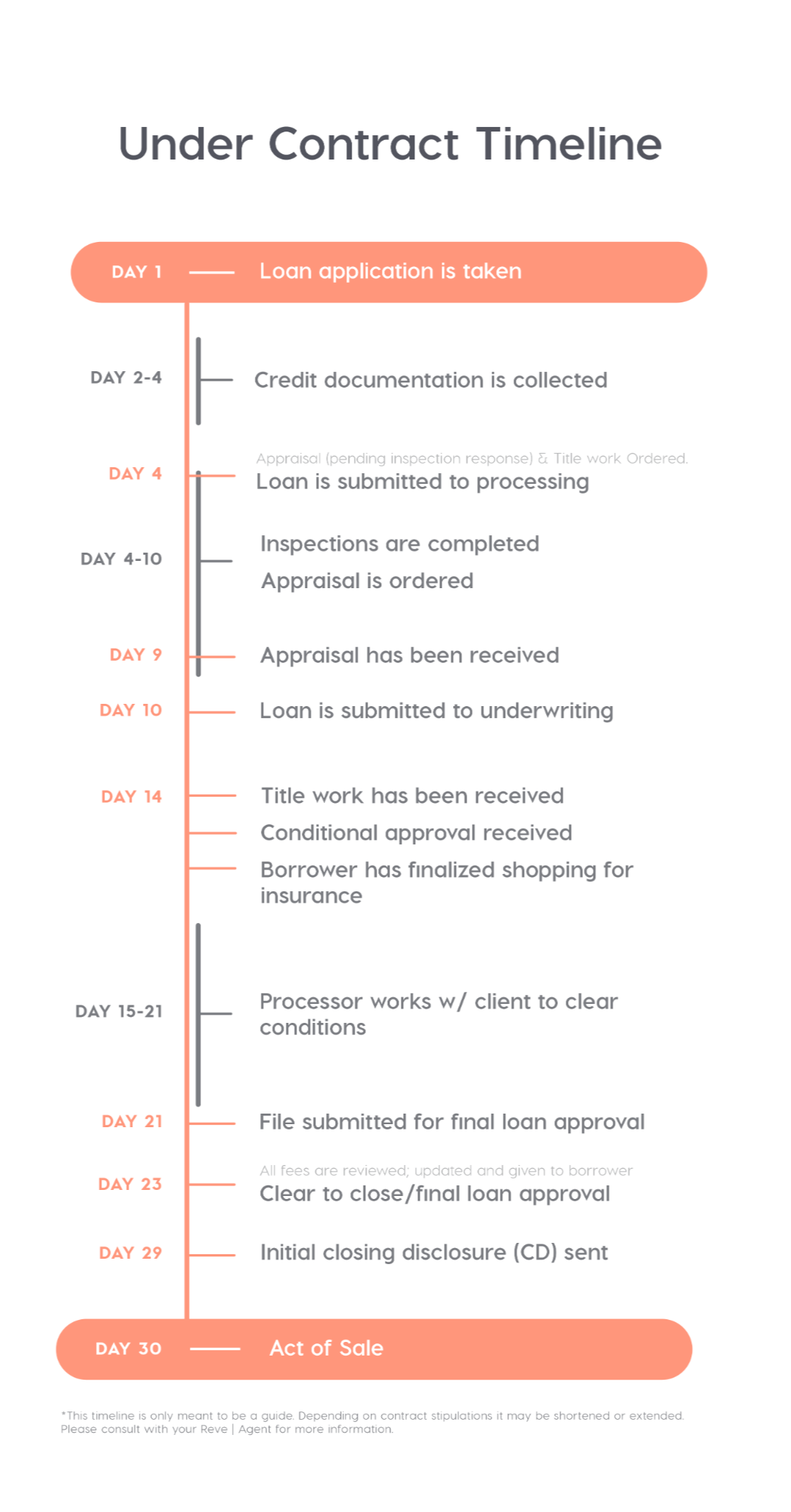

Day 1

Lender takes full loan application and pre-approves buyer for a home.

Day 2

Lender collects all required documentation including accepted contract and disclosures are mailed out if application taken over the phone. Title company needs to be decided on in order to ensure proper estimate of fees. Lender discusses locking into an interest rate with buyer.

Day 4-10

Buyer completes inspections and informs lenders when inspections are completed. If any changes to contract occur at this time, an amendment/addendum needs to be forwarded to lender immediately to make appropriate changes to disclosures. Submit file to processing

Day 4-12

Lender orders title, orders appraisal and re-discloses to buyer any changes that have occurred to the contract; Appraisal is received approximately 5-7 days afterwards

Day 10

File is submitted to underwriting.

Day 8-14

Appraiser inspects property and sends in appraisal report to lender. Lender gives a copy to the borrower and to processing department. Title work is received back. Buyer secures insurance on the home and sends to title co.

Day 14

Conditional loan approval is received

Day 9-16

Processing orders and completes all verifications needed for the file.

Day 12-18

Underwriter reviews file and sends conditional approval. Processor clears all conditions from underwriter and gives file back to underwriter for final clear to close.

Day 22-26

Underwriter clears file, gives to closing department to issue initial

Day 27-29

Closing Disclosure (CD) Closing department sends out closing package and title company balanced the CD with closer and closing is scheduled.

Day 30

Closing day! Meet at the title company as scheduled to sign the documents and get the keys to your new home! Be sure to have your I.D. and personal checkbook (just in case.) Keep all closing documents and information for your files